RECENT BLOG

SENTIMENT |

Just a Cycle

or a GD Hurricane?

Is It a Cycle or a GD Hurricane?

When it comes to building new homes, we all look to economic indicators for guidance. For instance, listening to the news, we might be told the University of Michigan Consumer Sentiment Index (UMCSENT) is up more than expected - rejoice! Or, conversely, that the sky’s falling in the index is a hundredth of a point below “experts” expectations.

As is the case with most data that splashes across our feeds and podcasts, the actual collection of the information behind the numbers is subject to uncertainty. For example, you might not know that the U of MI Consumer Sentiment data is based on 500 phone calls monthly. In these phone calls, people are generally asked how they feel about the economy and their personal finances. Ok, first of all, how many random surveys did you, my hard working friend, take the time to complete when a solicitor called this month? Second, there are approximately 346 million people that live in the US. I don’t need to go into a lecture on statistics and the significance of sample size for us to know this isn’t exactly a huge sample of data. The point is, this data seems, well, subject to scrutiny?

Still, a metric like consumer sentiment seems relevant to the housing market—after all, confident consumers are more likely to buy homes, right? The U of MI data has been around a long time too (the 50s, wow) and it seems to do a pretty good job. Recently, we have all decided the only thing that matters is CPI data and interest rates. Want to know how I know? My nine year old knows the current fed fund rates like it was dropped from a leaflet in the sky. Believe it or not, however, there have been moments where the Sentiment Index has been treated like Moses’ tablets on the mountain top.

There’s no denying that data, in general, is incredibly useful. That said, it works best (and worst) when you treat it like a buffet—sampling from a variety of sources rather than piling your plate with only one dish. The good news of a plethora of indicators is that focusing solely on sentiment data while ignoring inflation, or betting the farm on home prices without factoring in interest rates, is a fast track to some very naive conclusions. But, there’s a dark side to the buffet. How often do we cherry-pick the data we want to see, patch it together from a dozen sources, and call it definitive proof? Spoiler: that’s not how it works. Just because you stack up a pile of interrelated stats doesn’t mean you’ve cracked the code. Sometimes it’s better to zoom in on a single example to really see what’s going on—and maybe avoid some self-inflicted blind spots in the process.

This blog’s going to dive into what sentiment numbers tell us about new home sales. What is likely to be clear as we delve in is that much of the relationship between indicators is nuanced, cyclical, and, most importantly, not foolproof. It’s our hope at AddWork that armed with a little bit more context, you can be more prepared for the one thing that we know for darn sure is the future: uncertainty.

Sentiment is correlated to new home sales! Blamo, take that!

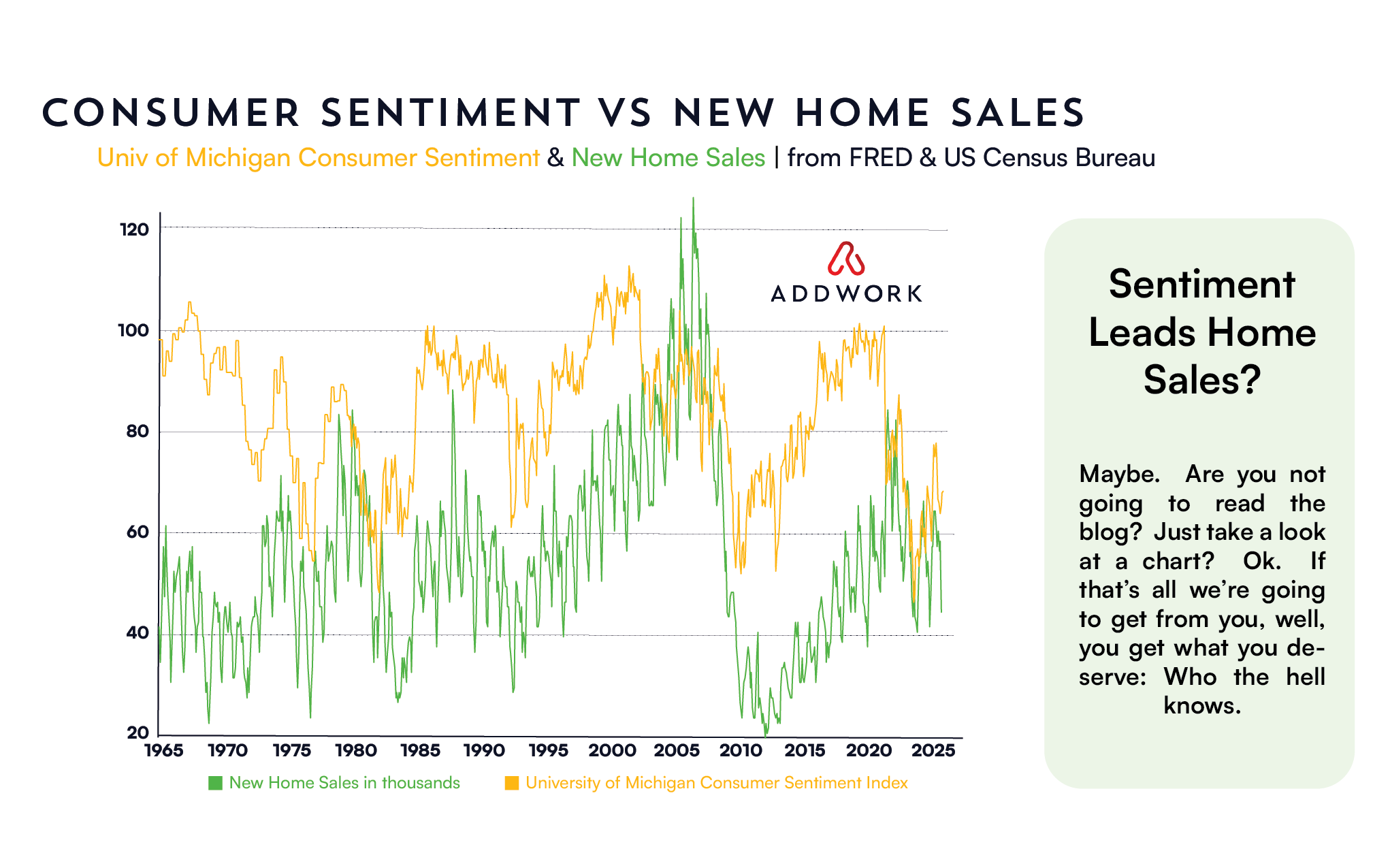

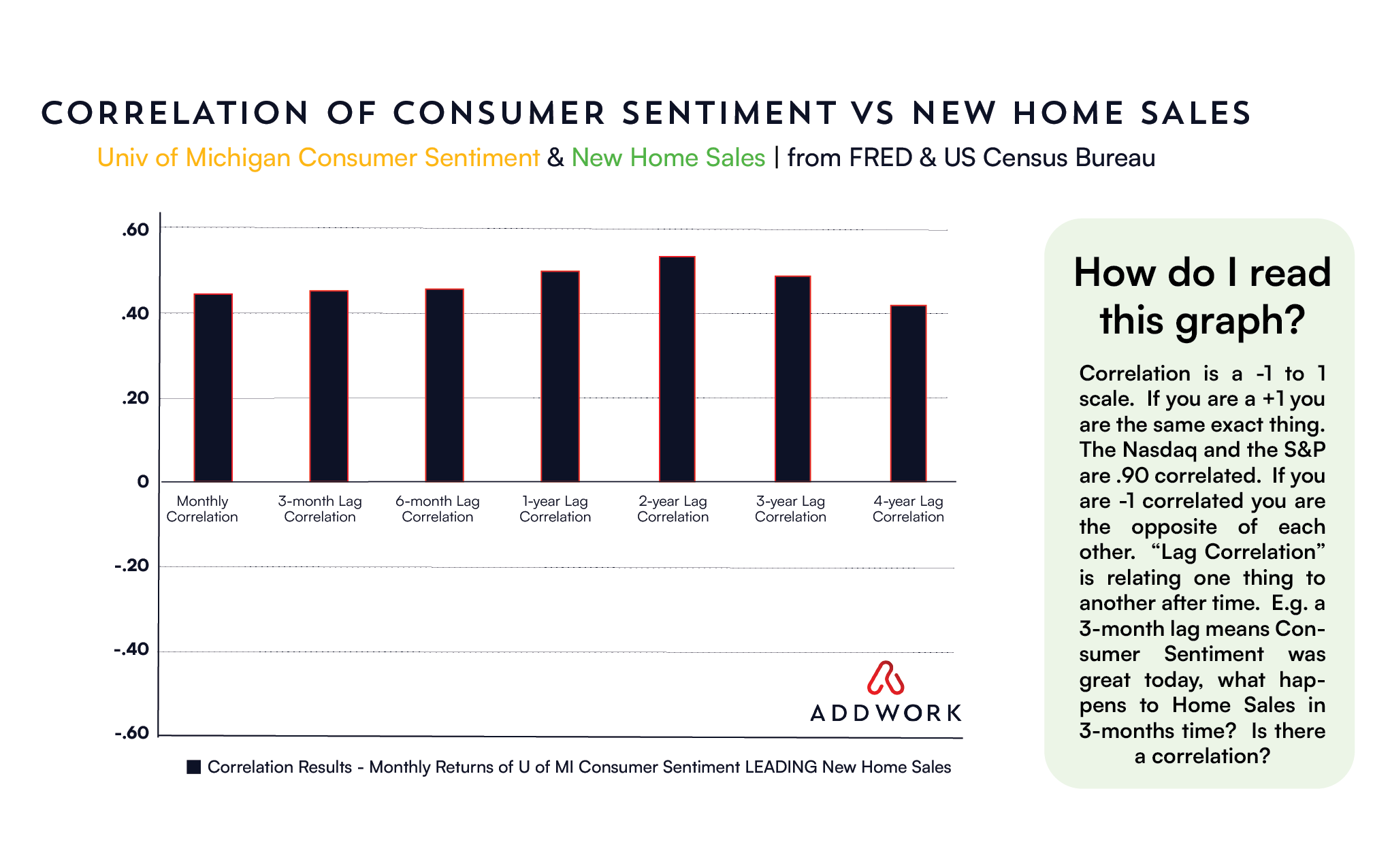

Looking at the data, the relationship between UMCSENT and new homes sold (based on U.S. Census data) shows a moderate correlation:

- Current month: ~0.44 correlation.

- Three months out: 0.45.

- Six months out: 0.46.

- One year out: 0.50.

- Two years out: 0.53.

What this data is saying, with some statistical significance, is that what consumer sentiment is today is correlated to new home sales. It’s correlated today (.44) and it’s correlated more meaningfully (.53) two years out. “Two years out” means that what sentiment is today (if it’s good), means it is an indicator with some confidence of good new home sales in 2-years time. If consumer sentiment is bad right now, you can expect that in two years there is a higher likelihood new home sales will be bad as well.

But how much is .44 or .53 correlated? Interestingly, that correlation is something like a “sweet spot” for a lot of things we see around us daily. It’s enough of a correlation that it can convince us that something is categorically true “because I’ve seen it.” For example, that’s about the correlation you would have between your height and your weight - eg taller people weigh a little more. It’s the correlation between how hard a student studies and their test score. It’s roughly how much more ice cream stores tend to sell on sunny days versus cold or rainy days. It’s a real correlation. But I’m here to tell you that the best test taker I’ve ever seen was a highschool friend that got a perfect on the SAT, never opened a textbook, snuck out of school to smoke and was the best dungeon master with a fake Australian accent in history. You get my point.

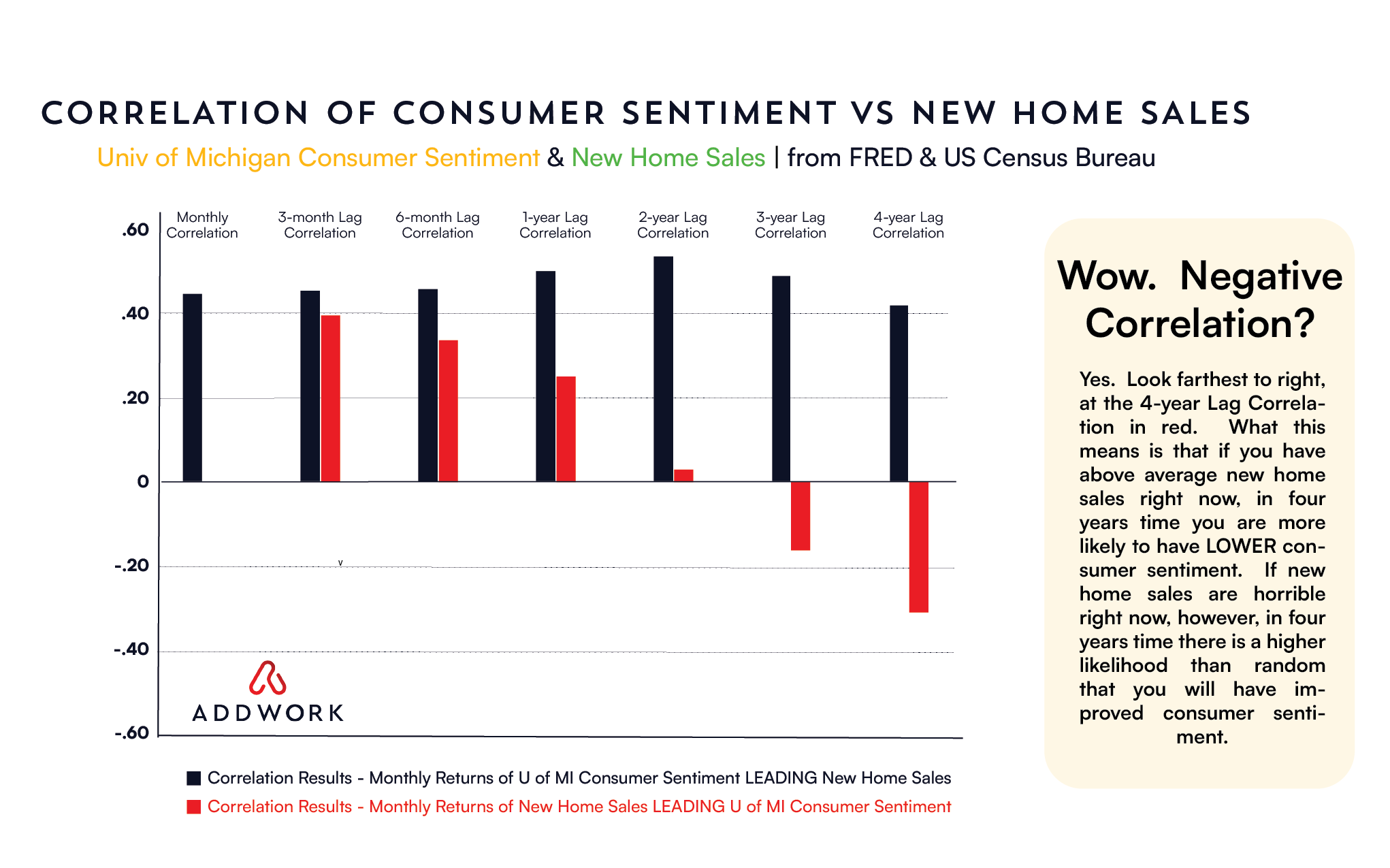

Sure, this data does suggest that consumer sentiment is moderately predictive of future new home sales. Please consider the graphics of this post to see how much. Fascinatingly, however, that prediction story isn’t reciprocal. When you look at new home sales today and try to predict consumer confidence two years out, the correlation drops to nearly zero. Builders looking at consumer sentiment as a whisper of future demand might find some guidance, but trying to infer broader economic trends in reverse from today’s new home sales is a futile exercise. In fact, to overly generalize, the better new home sales are today the more likely in two to five years the economy will be worse not better. It’s cyclical.

Timing matters

For builders, timing is the tightrope walk. Misjudging market cycles can lead to devastating outcomes, even if your predictions are “right” in the long run. For example:

- Launching a major development, taking out a ton of leverage, when consumer confidence is rising might seem like a good idea, but if you’re too early, you risk sitting on unsold inventory as sentiment slows.

- Conversely, being late to a market upswing can mean missing out on prime profits as the cycle peaks.

We took a look at how consumer confidence predicts future new home sales - there’s a link. But what about the other way around? What do new home sales tell us today about how optimistic consumers are about the economy and their own finances?

Generally, the data has a lot of noise - as can be seen in the graphics associated with this blog. However, when you look at four years out, the data tells a different story. What the data suggests at a -.31 correlation is that if new home sales are particularly high now, in four years time, consumer sentiment is likely to be lower than average. Similarly, if new home sales are very low right now, you can have some confidence that there’s a higher likelihood that in four years time consumer sentiment is going to be above average.

Consumer sentiment offers hints, but it’s one part of a complex web. The biggest risk is trying to prove your own agenda through the data. You can find almost anything to align with your point of view. In fact, reasonably often, the data will be there with correlations (or negative correlations) to back you up. But four years is a very long time when you have a 9-18 month build cycle. How do you lean in hard when that’s all you have to go by? You can point to the inevitability of lower interest rates two years from now, or improving CPI but those data points are pretty worthless. Lower rates in four years time is guaranteed right? … Right??? If you think so, give us some odds and let’s see how willing you are to put money where your dreams hope.

I Just Want a Straight Line; I Can't Read That!! Sorry.

One of the most important lessons for builders is understanding that the economy moves in cycles, not straight lines. Indicators like consumer sentiment may foreshadow trends, but they don’t guarantee outcomes. Builders need to plan for cycles and remain agile to adapt to changing conditions.

At this moment, as an example, depending on your window of observation, both Consumer Sentiment and new home sales are in a confusing morass. Depending on your lookback timeframe they’re telling you wildly different things. Sentiment is better than the bottom early last year (so are new home sales), but just. But overall Sentiment is way below levels peaking in 2019 before Covid (same with home sales). The point is, what is this really telling us? Almost whatever you want. How many times have people flashed charts with things indicating bubbles last seen in ‘08 or the roaring ‘20s? Your mind wants to connect the dots. You should resist that urge. If you could do that well you would be a Hedge Fund manager.

Indicators Are Better than the Oracles of Olympus - Maybe?

While consumer sentiment data can offer valuable insights, relying too heavily on any one indicator is dangerous. Housing markets are influenced by a myriad of factors:

- Mortgage interest rates.

- Supply chain disruptions.

- Demographics and migration trends.

- Regulatory changes.

Failing to account for these variables while focusing solely on sentiment can create blind spots in strategy. Further, and clearly in conflict with our last sentence, relying too much on too many factors can sometimes steer you right into a dead-end. Understand the value, there is some, and never forget the dangers; data will tell you what you want to hear.

Conclusion

Consumer sentiment is a useful tool for builders, offering a moderate glimpse into where new home sales might be headed. However, it’s not a crystal ball. The correlation between sentiment and sales grows stronger over longer time frames, but it’s still just one part of a larger economic picture. Builders must embrace the cyclical nature of the economy, using sentiment as one of many inputs in their decision-making process.

Above all, remember this: success in building isn’t just about being right—it’s about being right at the right time. Misjudging timing can be the difference between thriving and going under. There are some moments that are clear as day, the right time and the right consensus. Here’s one, things would improve from rock-bottom prices in 2009/’10, as an example. Why didn’t more people see that? Did you see it? Maybe not so easy to “know” for sure AND have ample resources to do something about it. There is one thing we will suggest with great confidence, ‘10/’11 is not right now. That time is clearly not now.

There is nothing in the data, or in the correlations, that are indicating anything definitive whatsoever. Sentiment data suggests a correlation, new homes data suggests a negative correlation over four years (a four year cycle), so where are we right now? No where. The data as you can see in the associated graphics is in the middle. We cannot make suggestions, it’s not our place. That said, what we’re doing is being active in the home building market but with an ample cash reserve war chest. This point in the cycle does not give much confidence one way or another, so let’s make sure we do what we do best and don’t get crippled by what we don’t know. We know what we do: build homes and make amazing software.

READY TO

GET STARTED?